Tax Extension Form Irs. Application for automatic extension of time to file u.s. Filing this form gives you until october 15 to file a return.

File form 4868, application for automatic extension of time to file u.s. You can file an irs form 7004 electronically for most returns.

Individual Income Tax Return Is An Internal Revenue Service (Irs) Form For Individuals.

There are several ways to file an extension with the irs.

You Can Request An Extension For Free, But You Still Need To Pay Taxes Owed By.

How to file a tax extension.

An Easy Way To Get The Extra Time Is Through Irs Free File On.

Images References :

Source: www.expressextension.com

Source: www.expressextension.com

File Personal Tax Extension 2021 IRS Form 4868 Online, There are several ways to file an extension with the irs. File form 4868, application for automatic extension of time to file u.s.

Source: form-w-8ben-e.com

Source: form-w-8ben-e.com

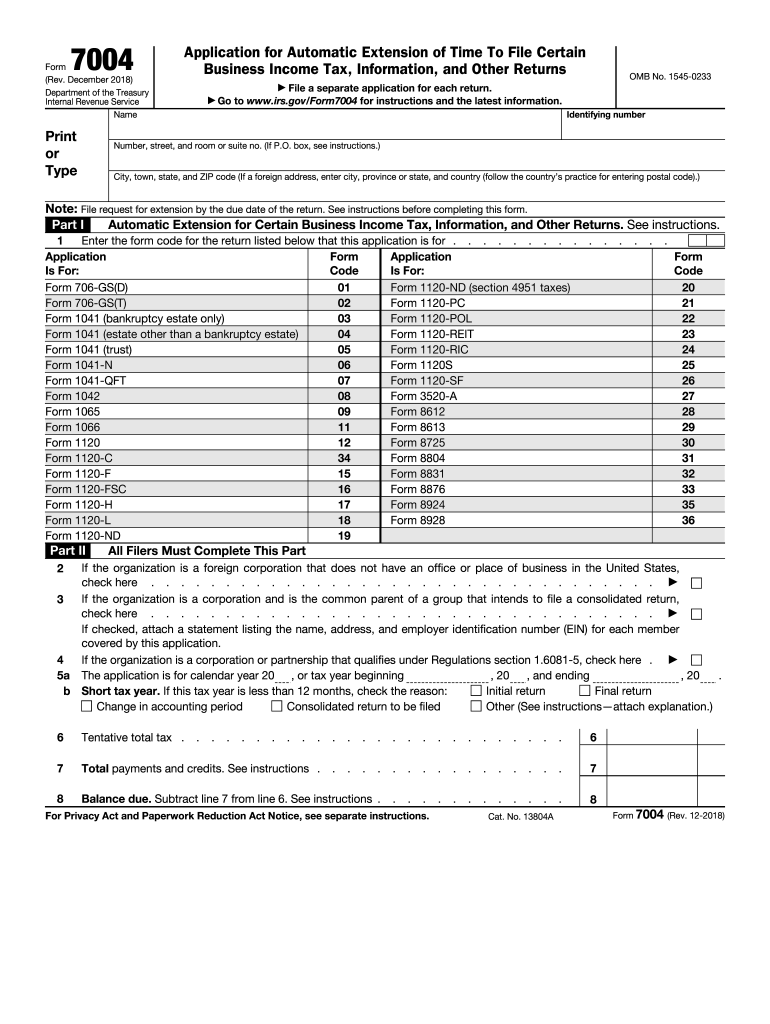

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online, You can request an extension for free, but you still need to pay taxes owed by. You can request an extension:

Source: www.dochub.com

Source: www.dochub.com

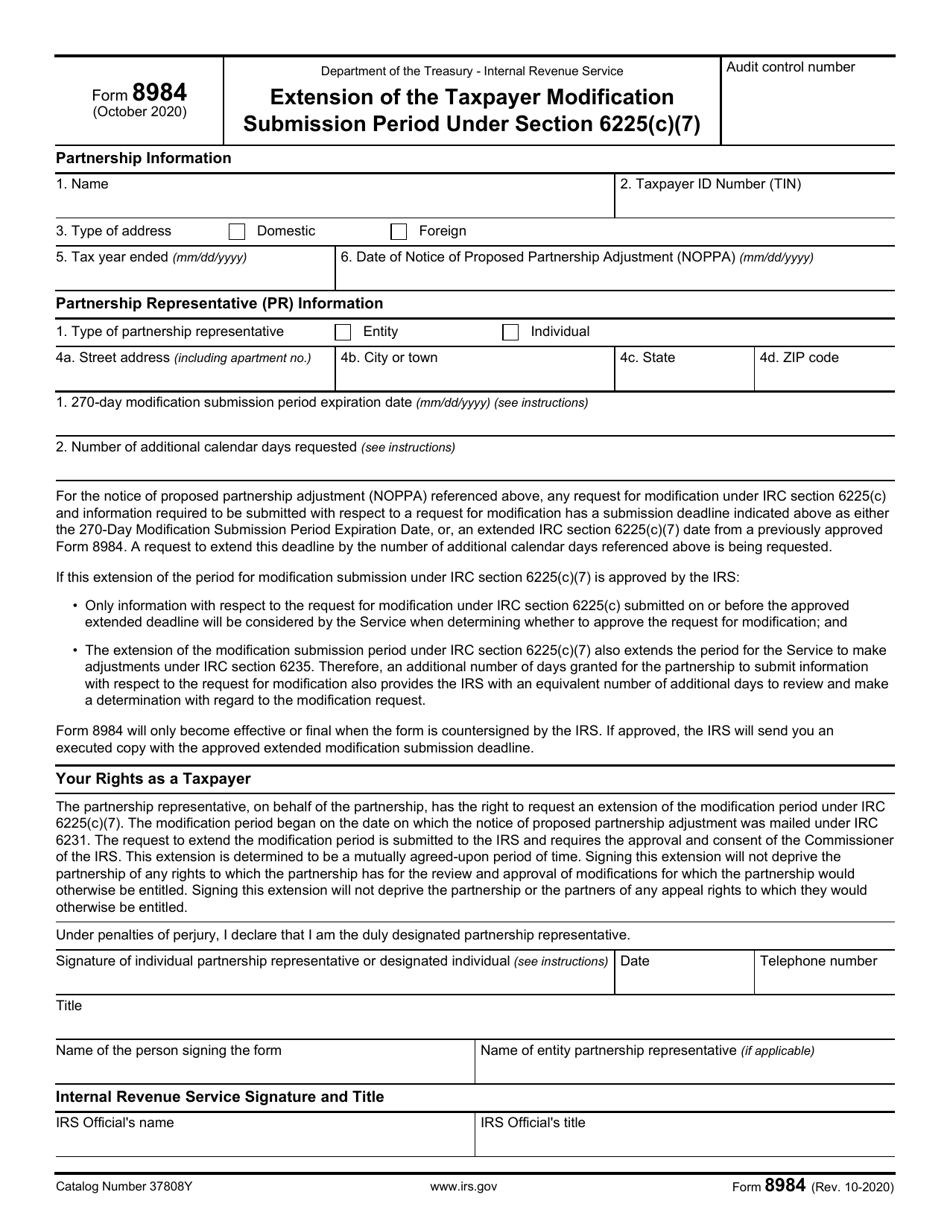

Irs application for extension Fill out & sign online DocHub, Form 4868 is the irs form you complete to receive an automatic extension to file your return. If you need additional time to file your state tax return by the due date, you can request an extension of time to file.

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 8984 Download Fillable PDF or Fill Online Extension of the, File form 4868, application for automatic extension of time to file u.s. The official document for requesting an extension is form 4868 and it is less than half a page long.

Source: www.slideshare.net

Source: www.slideshare.net

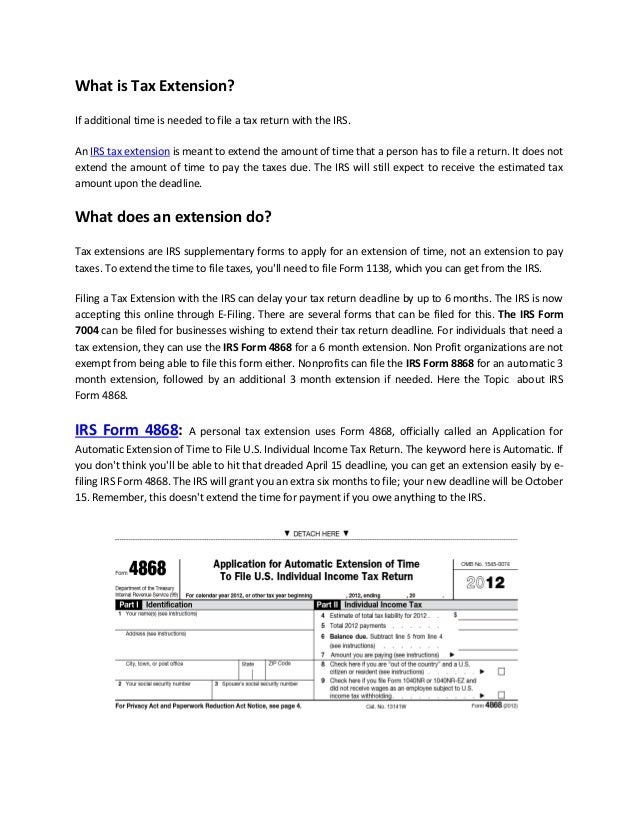

Irs tax extension form 4868, A tax extension is a request for an additional six months to file a tax return with the irs. If you feel that you may not be.

Source: www.slideshare.net

Source: www.slideshare.net

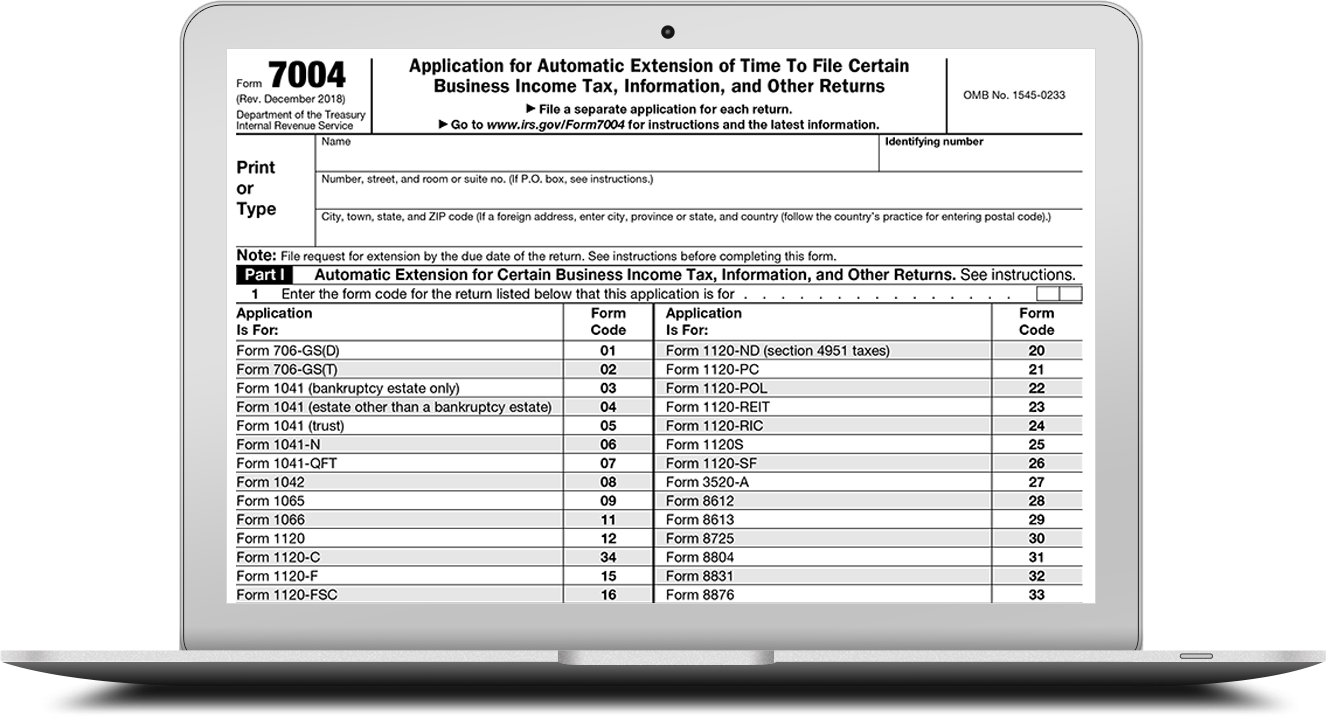

IRS Form 7004 Automatic Extension for Business Tax Returns, There is no cost to file for a tax extension. You can request an extension for free, but you still need to pay taxes owed by.

Source: www.marca.com

Source: www.marca.com

IRS Form 4868 How to get a tax extension in 2022? Marca, This form, too, will require you to estimate your tax liability, but you won't have to make a. Online using irs’ free file program;

Source: pdf.wondershare.com

Source: pdf.wondershare.com

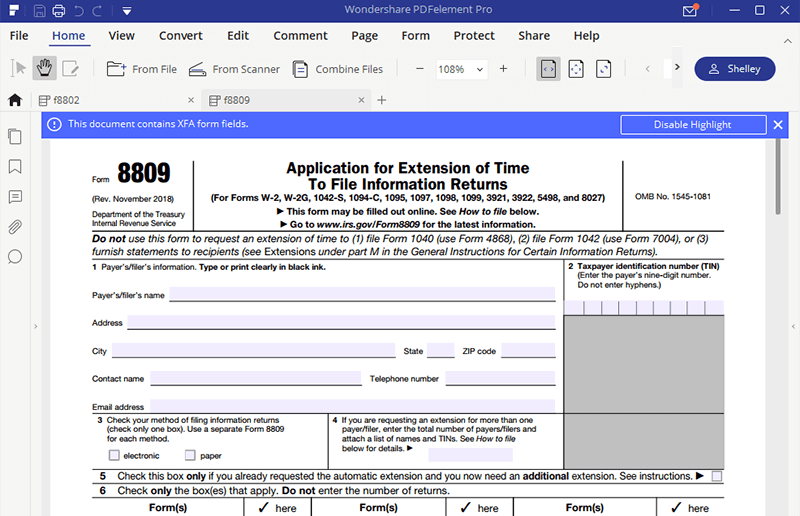

Tax Extension Form Extend Tax Due Date if You Need, Individual taxpayers, regardless of income who don't have tax due, can request an automatic extension by using irs free file or by submitting file. You can file an irs form 7004 electronically for most returns.

Source: irs-form-4868.com

Source: irs-form-4868.com

tax extension form 2019 Fill Online, Printable, Fillable Blank irs, Request for taxpayer identification number (tin) and. How to file a tax extension.

Source: www.expressextension.com

Source: www.expressextension.com

EFile 7004, 4868, 8809 & 8868 2019 Tax Extension Forms Online, This form, too, will require you to estimate your tax liability, but you won't have to make a. Request for taxpayer identification number (tin) and.

Easily File A Personal Income Tax Extension.

There are several ways to file an extension with the irs.

You Can File A Tax Extension Online In One Of Several Ways With H&Amp;R Block.

Please be aware that filing an extension gives you time to e.